Probate

Kelly-Ann Fransz, Lisa Whitelam and Laura Coleman-Day are our Probate Lawyers. For further information please visit our team profile pages.

Estates

Applying for the grant, collecting and distributing the assets

Our charges are primarily based upon time spent on any particular matter and depend in part on the complexity of the matter. For example, if there is one beneficiary and no property, costs may be at the lower end of the range. If there are multiple beneficiaries, the deceased died intestate, there is a property, multiple bank accounts or investments, costs could be at the higher end.

The costs incurred in dealing with the sale or transfer of property in the estate will be in addition to the administration costs.

It is difficult to specify timescales, however, we would hope to be in a position to apply for the grant of probate within 3 to 6 months of receiving instructions. Thereafter the timescale for concluding the administration of the estate and final distribution could be within a further 6 to 9 months depending upon the complexity of the matter.

On commencement of a new matter, once we know what work will be involved, we will provide you with a likely overall cost, including known expenses.

Our hourly charging rates are as follows:-

Kelly-Ann Fransz £280.00

Lisa Whitelam £318.00

Time spent by our experienced support staff is typically charged at half that of the solicitor rate.

Indicative charges:

Grant only application – on the basis that all relevant information is provided to us the costs will be in the region of £875 plus vat and probate registry fees and oath fees.

Grant only application – on the basis that we need to make some or all of the enquiries on behalf of the estate the costs will be in the region of £1,590 plus vat and probate registry fees and oath fees depending on the extent of the enquiries required.

Probate – the costs will depend upon various factors such as the size and value of the estate, the content of the Will to include the number of specific or pecuniary legacies and number of residuary beneficiaries and whether there are Inheritance Tax, Capital Gains Tax and Income Tax issues to be addressed.

The costs of a straightforward estate where all relevant information is provided and there are minimal financial assets and beneficiaries with no tax issues typically start from £1,600 plus vat and expenses.

The costs of a typical more complex estate where there are more financial assets, beneficiaries and tax issues typically range from £3,500 to £5,000 plus vat and expenses.

The costs of a complex estate range from £5,000 to £10,000 plus vat and expenses.

We do not charge any additional percentage on the value of the estate assets, our charges our based on the time spent on the case.

There may also be expenses known as disbursements that will not be included in the figures above. This could include;

- Probate Application fee £155 plus 50p per office copy

- Fees for the swearing of Oath typically £7.00 per executor

- Bankruptcy searches £2.00 per name

- Land Registry Office Copy entries £3.00

- S27 Trustee Act 1925 notices – vary depending upon the advertising requirements

- National Wills Register Search £90 plus vat

- House Valuations *

- Share Valuations *

- Jewellery Valuations *

- House Clearance *

*Prices subject to individual requirements.

Residential Conveyancing for Consumers

The Practice’s charges for sale, purchase and re-mortgage vary based on the value of the property concerned and, in some cases, where it involves freehold or leasehold property, shared equity purchases or other more complex arrangements.

Our costs include all expenses and VAT and on commencement of a new matter we would give you a fixed fee quotation in the knowledge of all known factors which can affect the complexity.

Please call us on 01427 610761 for a quotation which will be confirmed in writing.

For illustration purposes a sample of our current charges is shown in the table below. These figures are our total costs including VAT but excluding disbursements (some of which depend on the location of the property) Land Registry Fees (which depend on the nature of the transaction) and any Stamp Duty Land Tax (which depends on the circumstances of the Buyer and the value of the property ).

| Property Price | Sale | Purchase | Re-mortgage |

| £50,000 | £811.00 | £927.00 | £555.00 |

| £100,000 | £1,021.00 | £1,047.00 | £597.00 |

| £250,000 | £1,749.00 | £1,868.00 | £799.00 |

Likely disbursement costs for a Purchase of a property valued at £250,000.00 and based on a property already registered at the Land Registry, would be £492.00. Stamp Duty, assuming the standard rate applies, is currently zero.

For a Sale of the same value property, the disbursement costs would be £36.00.

Timescales for any transaction are very much dependant on the other parties involved in the chain, whether there is a mortgage and if any unexpected issues arise out of the legal work we carry out on your behalf. Typically we are completing transactions within 5 – 8 weeks of instruction.

We do not pay any form of introducer or referral fees.

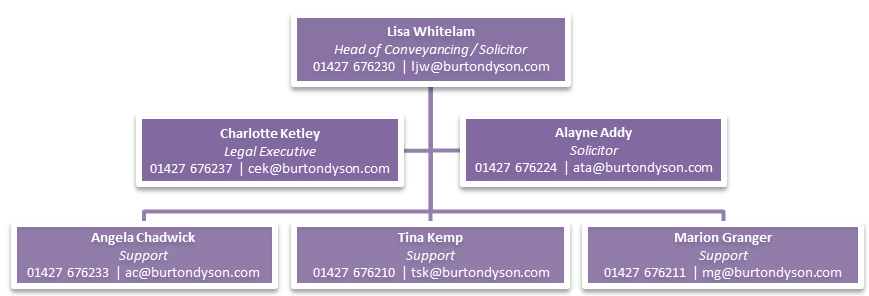

Details of our Residential Property Team are detailed in the diagram below. For further information please visit our team profile pages www.burtondyson.com/about-burton-and-dyson/our-team/

Employment Tribunal Unfair Wrongful Dismissal (not including appeals from Employment Tribunals)

Lisa Whitelam, Steven Hardy & Laura Coleman-Day deal with employment matters in the firm. Their hourly rates are;

| Steven Hardy: | £378.00 |

| Lisa Whitelam: | £318.00 |

If matters proceed to a fully contested hearing charges can range, in our experience, from £5,000.00 to £12,500.00 plus VAT

Factors affecting that range are primarily the number of days for a hearing, which itself depends on the number of witnesses, and whether any particular point of law arises to be determined.

There are presently no court fees in the Employment Tribunal, however, that is under review.

If a matter is complicated, we may involve a barrister on a fixed fee basis, which, depending on the length of the hearing and seniority can range from £3,500.00 to £10,000.00 plus VAT.

We would give you an indication as soon as circumstances allow of the likely cost in your particular case.

Where matters of discrimination arise, we would discuss the costs implications with you at the outset.

Debt Recovery

Debt recovery is conducted typically on behalf of clients as part of their wider general instruction to us to act for them.

Accordingly, we approach such work on an ad hoc basis once court proceedings become imminent. Up to that point we can provide fixed fee work by prior agreement with clients and typical charges are as follows;

| £150.00 | Letter before action |

| £106.00 | Follow up letter |

| £190.00 | Issue and serve statutory demand |

| £415.00 | Draft and serve court proceedings based on an unpaid invoice without issuing at court and incurring fee |

Thereafter costs would depend on complexity and debt level to include variable court issue fees and likely barrister costs for drafting of claim form.

In the event of successful recovery, the debtor could be ordered to pay the creditors costs but this is by no means certain and depends on the individual circumstances of each claim. We can discuss the recoverability of your costs when it is clear what the issues in the case are likely to be.

Summary

This pricing information is given in good faith to assist an enquirer to assess in general terms the likely level of expense involved in instructing Burton and Dyson in these defined areas of work . In every case you should not hesitate to speak to one of our team who would be happy to assist with any cost enquiry and at no charge.